Understanding the Mechanics of Blockchain Blocks

Blockchain Technology Blockchain, Blocks, Cryptography, Decentralized LedgerUnderstanding Blocks in a Blockchain

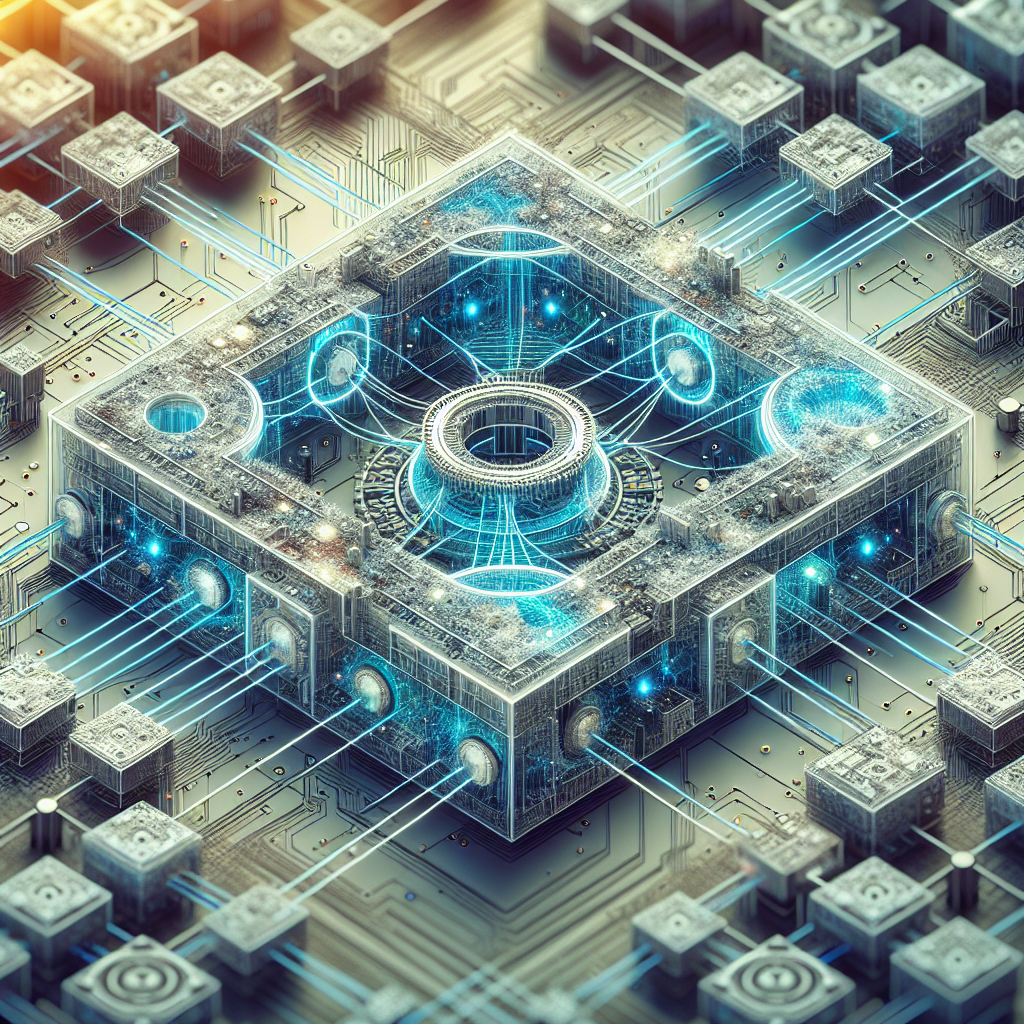

A blockchain is built on blocks, the cornerstone of this digital structure, housing a series of confirmed transactions and cryptographic connectors to previous blocks, thus creating an indelible network ledger.

The blocks in a blockchain are digital vaults that securely and permanently store transaction data for the network. When transactions arise, they’re sorted and compiled into a block. This block, post-validation by the network, is then cryptographically linked to preceding blocks. This creates an unalterable chain, where changing one block affects the entire sequence.

Blocks function not only in cryptocurrency networks but extend to other domains such as supply chain tracking, digital identity, and smart contracts. They serve as secure digital vaults that house verified transactional data and links to other blocks in their chain, which are verified before new blocks can be generated.

Each block contains a unique identifier (a hash), derived from its own content and the hash of the prior block. This hash secures the sequence of blocks in a chain.

Active blockchain networks perpetually handle fresh transactions, organizing them into blocks that represent the underlying units of the blockchain network. These blocks are constructed to hold information securely.

To visualize, consider each block as a page in a digital ledger with two principal parts:

- A header with essential details

- A body documenting all the transactions

Mechanisms for Adding Blocks to a Blockchain

There are two predominant methodologies for block approval and addition to the chain:

- Proof-of-Work (PoW): Here, participants, or validators, stake cryptocurrency as a security deposit to validate blocks, earning income like tokens in return.

- Proof-of-Stake (PoS): In this model, validators earn the right to approve blocks based on their cryptocurrency stake, collaborating to validate transactions without tackling puzzles.

Bitcoin and Other PoW Systems

In such systems, the header serves as a summary, encompassing:

- The system’s version

- A hash linking to the preceding page

- A timestamp indicating creation

- Technical aspects illustrating creation difficulty

- A “nonce,” attesting to the proof of work

The body records all monetary exchanges (transactions) executed during that time.

Adding a new page to this ledger involves puzzle-solving by miners who compete by altering a nonce until it fits the criteria. If unsuccessful, retrying with slight modifications follows.

Ethereum and Other PoS Systems

In these systems, the header similarly holds basic data:

- System version

- Link to a preceding block

- Timestamp

- List of selected validators and their signatures, confirming block verification

Validators approve transactions and collectively approve the block without needing to solve puzzles, with their selection based on their stake.

Once validated, a block becomes a permanent chain component, unchangeable and unremovable.

The Economic and Technical Implications

The substantial energy requirements of systems like Bitcoin highlight a major concern. Trying to decipher complex cryptographic puzzles often necessitates large-scale data centers operating at maximum power. As a reference point, U.S. mining operations directed towards Bitcoin production consume energy comparable to that of Poland.

Despite significant attention and investment in blockchain technology, it confronts core technical and economic obstacles that impede its full-scale adoption. Grasping these constraints is vital for assessing the numerous claims about its potential applications.

A significant distinction to note is between public and private blockchains:

- Public blockchain: Open access without restrictions, allowing anyone to view or use block data.

- Private blockchain: Restricted data access, confined to verified users, as seen in corporate financial transaction applications.

Blockchain Evolution and Challenges

Experts categorize blockchain’s evolving applications into multiple phases:

- Blockchain 1.0: Initial blockchain applications that foster smart contracts and similar features.

- Blockchain 3.0: Deployment of blockchain broadly across societal sectors, from education and healthcare to governance.

Scaling the Blockchain

For Blockchain 3.0, significant scaling is necessary, keeping in mind the blockchain’s inherent design trade-off among:

- Decentralization: Distributing decision-making power across the network.

- Security: Safeguarding data integrity and preventing unauthorized access.

- Scalability: Handling transactions per second efficiently while expanding.

To illustrate, while credit systems like Visa Inc. can process up to 60,000 transactions per second (TPS), many blockchain networks achieve far fewer.

Exploring the Trade-off

Enhancing one of these three aspects often necessitates compromising at least another. Here is the dynamic between them:

Decentralization vs. Scalability:

- Increased decentralization requires more nodes for transaction verification, slowing the network.

- Faster networks reduce validators, enhancing speed but centralizing control.

Security vs. Scalability:

- Stringent security involves meticulous validation processes, decelerating transaction processing.

- Rapid systems gain speed by relaxing security measures.

Decentralization vs. Security:

- Dispersing control bolsters security but reduces threat response efficiency.

- Centralized systems respond swiftly to threats but concentrate control.

This isn’t a fleeting technological challenge solvable with advanced hardware or programming. It’s an innate constraint, with each blockchain network negotiating its equilibrium for particular needs.

Block Attributes and Variations

Block creation time varies vastly depending on the blockchain network. For example, Bitcoin averages around 10 minutes per block, whereas Ethereum processes new blocks every few seconds.

In certain blockchains, the block might be identified by a sequential “block height,” such as Block 1, Block 2, and so on. Others use a specific identifier like a block header or hexadecimal number.

Block size limits significantly influence network performance and accessibility. Larger blocks accommodate more transactions but demand increased storage and bandwidth, complicating individual node operation. Conversely, smaller blocks ease processing and validation but restrict transaction capacity.

Blocks are at the core of blockchain technology, operating as secure digital vaults for transaction data. Through precise cryptographic connections and consensus mechanisms like PoW or PoS, blocks generate an unchangeable record, the backbone of blockchain systems. Although the scalability trilemma presents ongoing challenges, blocks remain the fundamental structure supporting decentralized record-keeping applications.